WHAT TO KNOW ABOUT CARBON CREDITS

According to a recent Intergovernmental Panel on Climate Change (IPCC) report, projected global warming may reach 0.8oC to 1.2oC above pre-industrial levels between 2032 and 2052. The rise in temperature is predominantly due to anthropogenic activities such as burning of fossil fuels, deforestation, and industrial emissions.

Companies seeking to offset their greenhouse gas (GHG) emissions have turned to carbon credits and carbon offsets. This is because governments have been pressuring the private sector to limit GHG emissions forcing these companies to turn to financial products that help them offset their environmental footprints through carbon credits and offsets.

What are carbon credits?

Carbon credits can be thought of as a tradeable permit that allows a polluter to emit one tonne of carbon dioxide or the equivalent amount of a different greenhouse gas. A carbon credit represents the right to emit or release emissions. A single credit represents 1 ton of CO2e (carbon dioxide equivalent) that the company is allowed to emit. They can be purchased by an individual or a company to make up for carbon dioxide emissions that come from industrial production or transport. Meaning institutions can emit carbon dioxide emissions and in exchange the world’s large reserves of forest will soak up the emitted CO2. The tradable component of carbon credits makes it a very lucrative market, known as the carbon market, with revenues of about $95B in 2023 and is projected to grow in the future.

The number of credits issued to a particular company or organization represents its emissions limit. If a company can limit its emissions below its cap, it is considered compliant and has a surplus of carbon credits. These can be retained for future use, or they can be sold immediately into the carbon compliance market overseen by a regulatory body. This market is known as a cap-and-trade market.

If the company cannot keep emissions under its limits, they are non-compliant and must make up that difference. Over-emitters turn to the carbon market to purchase carbon credits from an under-emitter within the cap-and-trade network.

How are Carbon Credits Created?

Carbon credits are based on the cap-and-trade model that was used to reduce sulphur pollution in 1990. They are most often created through agricultural or forestry practices although a credit can be made by nearly any project that reduces, avoids, destroys, or captures emissions. Individuals or companies looking to offset their own GHG emissions can buy these credits through a middleman or those directly capturing the carbon (voluntary market). Carbon credits, meanwhile, make it more expensive for companies in regulated industries to pollute by charging them per unit of carbon they emit, which has the effect of disincentivizing future emissions.

Alternatively, they can buy the credits through compliance or involuntary markets. Involuntary markets are those set up by governments when they set a cap on how many tons of emissions certain sectors such as oil, transport, energy, or waste management, can release. Companies must trade to stay within the limit.

There are about 75 carbon compliant markets in operation around the world.

Regulators, businesses, and environmentalists have debated globalizing a cap-and-trade market for carbon. However, it is challenging to agree on a common time frame, common price, common measurement, and transparency. The voluntary market’s rapid acceleration is largely driven by recent corporate net-zero goals and interest in meeting international climate goals set out in the Paris Agreement to limit global warming to 1.5 degrees Celsius over pre-industrial levels.

Drawbacks of Carbon Credits

Carbon credits can easily be labelled as green washing. A company can claim they have bought carbon credits from a business outside a regulated exchange, and this does not lower the overall amount of GHGs released by buyers. It gives corporations a way to claim they are eco-friendly without reducing their overall emissions.

The voluntary market operates largely unchecked by federal or local regulators. The market does not have a cap on how many tons of emissions can be offset and the driving oversight is a set of standards. There are a few respected standards organizations that validate carbon credits. Verra, a non-profit has set the most widely used standard to validate credits called the Verified Carbon Standard. Since its launch, it has registered 1,750 projects around the world and verified 796M carbon units.

What is carbon off-setting?

Carbon credits and carbon offsets are often mistakenly used interchangeably, but they are not the same. However, the unit of measurement for both is tonnes of CO2e. Carbon credits are a measurement unit to cap emissions while carbon offsets can be thought of as a measurement unit to compensate an organization for investing in green projects or initiatives that remove emissions.

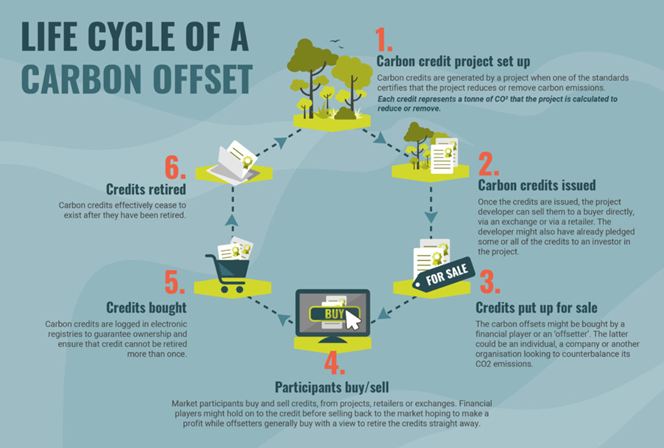

Carbon offsets are designed to help consumers or organizations counteract the impact of future or past emissions. Offsets can also be traded in a voluntary carbon market. Carbon offsets occur when a polluting company invests in a project that reduces GHGs for example a project that deals with sustainable clean energy to counteract the use of fossil fuels. In a nutshell, carbon offsetting cancels out emissions produced in one place with the reduction of emissions in another place i.e. projects such as wind farms or tree planting exercises. Another way to look at it are carbon offsets are a way to make amends for committing an environmental sin of polluting the air with GHG emissions.

According to the World Bank, carbon credits regulate around 18% of the world’s emissions, while carbon offsets track far less than 1%.

It is important to note that offsets are not created or distributed by a specific regulatory body. They are also not limited to individual regulatory jurisdictions and can be traded on any number of voluntary markets around the world.

Conclusion

Carbon credits and carbon offsets are a great incentive theoretically to deter and curb unregulated carbon emissions. However, there needs to be increased monitoring of the projects to ensure adequate absorption and capture of GHGs that these carbon markets propose to be undertaking. In the long run this will make carbon markets a major solution to climate change.